Is Amazon Concerned About Temu and Shein?

the online shopping race is on and it looks like Temu and Shein are gaining on Amazon. According to a report from The Wall Street Journal, the Bezos helmed online retailer is now more concerned with the newer online platforms than they are of Walmart and Target.

Cheddar

U.S. stocks mostly fell again on Monday as investors continued to scale back expectations for Federal Reserve rate cuts after Friday’s strong jobs data pointed to a still strong economy.

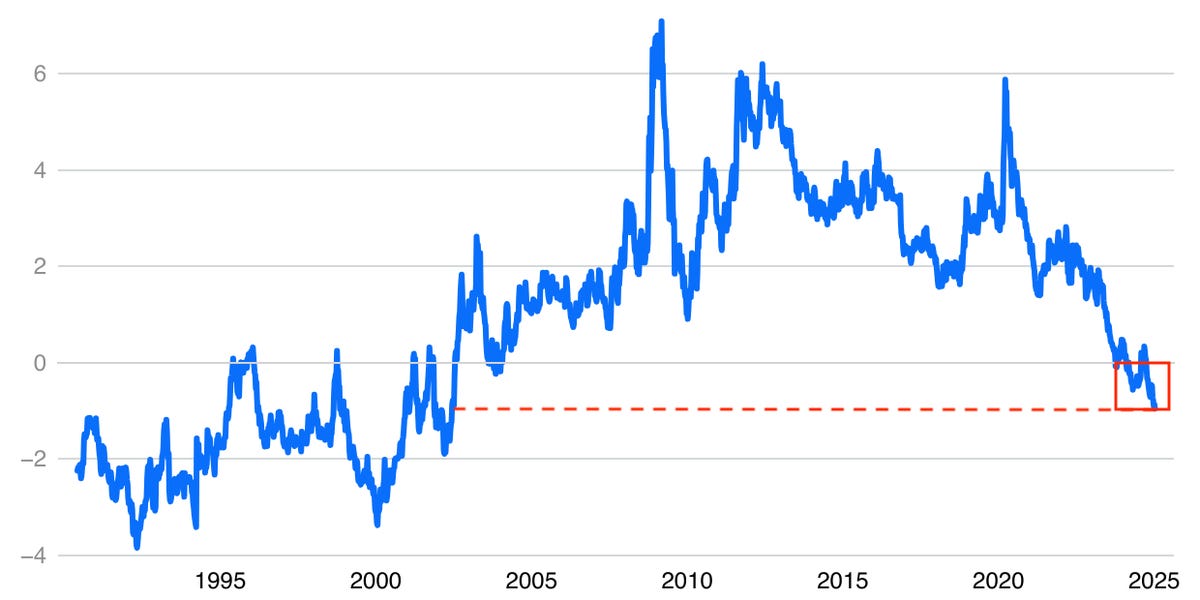

The benchmark S&P 500 hit a two-month low as bond yields surged on views the Fed will keep interest rates higher for longer this year. Around 11 AM ET, the broad S&P 500 index was down 0.43%, or 24.89 points, at 5,802.15, the blue-chip Dow up 0.42%, or 177.76 points, at 42,116.21 and tech-heavy Nasdaq down 1.04%, or 199.90 points, to 18,961.43. The benchmark 10-year yield was last up at 4.786%.

Bank of America economists have erased their rate cut expectations and now see a rate hike as the more likely next move. “Inflation is above target and the Fed was primarily cutting to ensure a strong labor market, which has been met,” they said in a note. “This means no further cuts needed,” adding they “see risks for the next Fed move more skewed to a hike versus cut.”

Chip stocks battered

Chip darling Nvidia and other semiconductor stocks lost ground after President Joe Biden’s administration proposed new U.S. chip export curbs.

In an attempt to thwart China’s advance in artificial intelligence (AI) and protect national security, the U.S. said it wants to cap how many advanced AI chips can be exported to certain countries. Eighteen key allies and partners would be exempt, it said.

Companies decried the framework, with Ned Finkle, Nvidia vice president of government affairs, calling the proposal “misguided,” and saying it “threatens to derail innovation and economic growth worldwide.”

The proposal has a 120-day comment period, which would run into the start of President-elect Donald Trump’s term. Trump’s inauguration is Jan. 20.

Shares of Nvidia were down 3.77% at $130.79 and Intel was down 2% at $18.77.

Oil prices jump

Oil prices rose for a third consecutive session, with Brent crude rising above $80 a barrel to its highest in more than four months, in the wake of wider U.S. sanctions on Russian oil that could push India and China to buy more oil from the Middle East, Africa and the Americas, boosting prices and shipping costs, analysts said.

On Friday, the U.S. Treasury imposed new sanctions on producers including Gazprom Neft and Surgutneftegaz, and183 vessels that have shipped Russian oil, targeting revenue Moscow has used to fund its war with Ukraine.

Other movers

Other stocks with big moves Monday include:

- Moderna cut its 2025 sales forecast by $1 billion, and shares were down more than 21%.

- U.S. Steel shares rose after CNBC’s David Faber reported, citing sources, that Cleveland Cliffs and Nucor were partnering in a potential bid for the steel giant.

- Howard Hughes Holdings, a real estate developer, jumped 9% after Bill Ackman’s Pershing Square proposed a deal to merge with the real estate company, in a new entity, offering current holders $85 a share.

Medora Lee is a money, markets, and personal finance reporter at USA TODAY. You can reach her at mjlee@usatoday.com and subscribe to our free Daily Money newsletter for personal finance tips and business news every Monday through Friday morning.