The S&P 500 (SPX) index is rising on Monday as the stock market continues to regain lost ground after last week’s Federal Reserve meeting. This meeting had the Fed warn that it might slow plans to lower interest rates in 2025. This upset investors, despite the central bank announcing a 25 basis point drop after the meeting.

Don’t Miss Our Christmas Offers:

The initial news of slowing rates sent the S&P 500 diving on Wednesday and Thursday, with the index still down 1.65% over the last five days. However, recovery is happening with the SPX up 0.25% as of this writing. It’s also still been a good year for the index with a 24.34% year-to-date increase.

Stocks Boosting the S&P 500 Index Higher Today

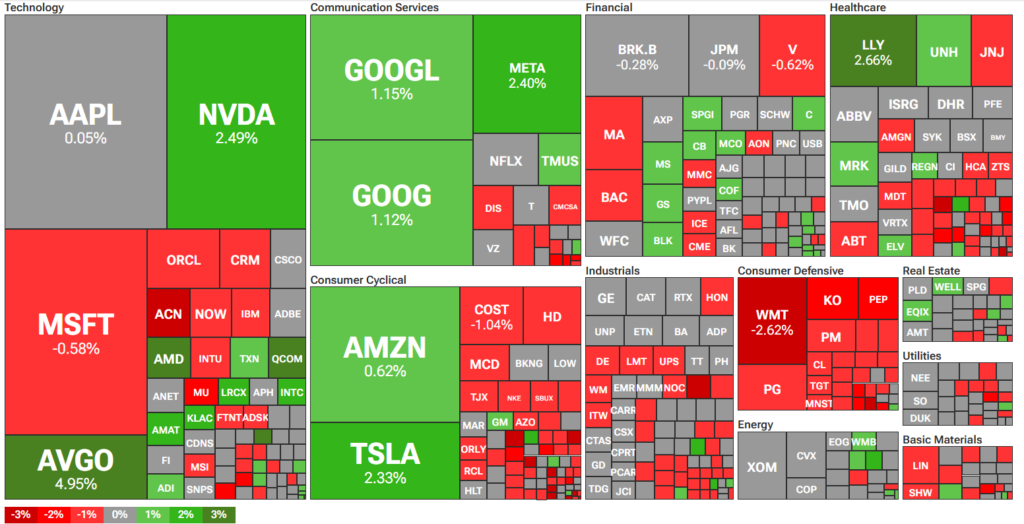

Semiconductor stocks pulling the S&P 500 higher on Monday with strong movement from Nvidia (NVDA), Broadcom (AVGO), and Advanced Micro Devices (AMD). Other stocks contributing to the index’s gains include Meta Platforms (META), Tesla (TSLA), Alphabet (GOOGL), Eli Lilly (LLY), and many others visible on the following heatmap.

How to Invest in the S&P 500

Investors can’t take a direct stake in the S&P 500 as it’s an index. However, one option they do have is buying shares listed on it. Any of the ones helping lift the index higher today are good options. Traders may also want to use dips from other stocks on the index as lower entry points to gain exposure to the SPX.

Another option is owning shares of an exchange-traded fund (ETF) that tracks the S&P 500. Investors can choose between those that bet on or against the index. One popular option is SPDR S&P 500 ETF Trust (SPY), which is up 0.21% today and 25.97% year-to-date. You can compare this to other ETFs below!

See more S&P 500 ETFs

Disclaimer