S&P 500 BREADTH IN FREE FALL

The S&P 500 index SPX is down less than 1% from its 6,090.27 December 6 record closing high.

However, since peaking at an all-time high on November 29, the S&P 500’s daily advance/decline (A/D) line has been falling precipitously. In fact, the A/D line is now on track to decline for a 12th day in a row.

Using LSEG data on the S&P 500’s A/D line, which goes back to summer 2012, this breadth measure is on a record daily losing streak:

The NYSE A/D line has also recently turned down from a record high. The Nasdaq A/D line, which as long been beleaguered, is at fresh record lows.

Over the last 4-5 years, S&P 500 A/D line peaks have tended to be coincident with significant highs in the S&P 500 index. So, it remains to be seen if the recent A/D line top, five trading days ahead of the SPX’s record close, proves to be pivotal or not.

The NYSE A/D line recently gave no divergence warning as it topped the same day as the NYSE Composite NYA. Of note, ahead of the 2022 bear market, the NYSE A/D line topped in November 2021, 45 trading days ahead of the NYA’s peak.

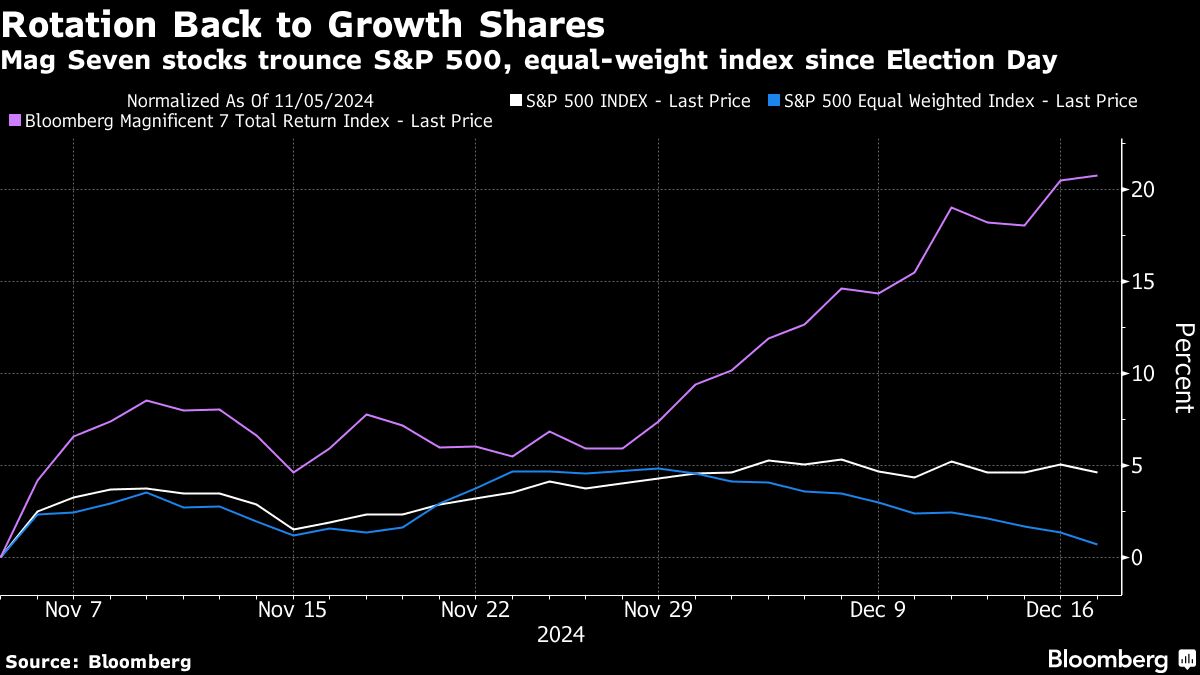

Meanwhile, recent S&P 500 and Nasdaq strength has no doubt been underpinned by Mag 7/tech titan names, helping these indexes defy internal weakness.

Indeed, the NYSE FANG index NNYFANG which includes six of the Mag 7 stocks, has surged more than 10% so far this month. The SPX is just barely positive in December, while the S&P 500 equal-weighted index (.SPXEW) is down about 4% this month.

With this, the SPXEW/NYFANG ratio fell to an all-time low on Monday.

(Terence Gabriel)

*****

FOR TUESDAY’S EARLIER LIVE MARKETS POSTS:

SOLID RETAIL SALES IS THE MAIN COURSE IN TUESDAY’S DATA BUFFET – CLICK HERE

WALL STREET EASES EARLY AFTER RETAIL SALES – CLICK HERE

DOW INDUSTRIALS ON VERGE OF EYE-POPPING LOSING STREAK – CLICK HERE

UPSIDE IN EUROPEAN CYCLICALS BUT NO BUYING YET – BOFA SURVEY – CLICK HERE

THE OUTLOOK FOR THE EURO? BETTER LOOK AT CHINA – CLICK HERE

STOXX DOWN, TRADERS EYE CENBANK CALENDAR – CLICK HERE

EUROPE BEFORE THE BELL: FUTURES DOWN, CENBANK BONANZA LOOMS – CLICK HERE

INVESTORS LOOK PAST POLITICS TO CENTRAL BANK MOVES – CLICK HERE