Published on December 20th, 2024 by Bob Ciura

In the world of investing, volatility matters. Investors are reminded of this every time there is a downturn in the broader market and individual stocks that are more volatile than others experience enormous swings in price.

Volatility is a proxy for risk; more volatility generally means a riskier portfolio. The volatility of a security or portfolio against the mean is called standard deviation.

In short, standard deviation is an investing metric that calculates the magnitude of a security’s dispersion from its average price over a given time period.

As a result, we believe standard deviation is an important financial metric that investors should familiarize themselves with, when purchasing individual stocks.

To that end, we created a list of low volatility stocks. The list includes the 100 lowest standard deviation stocks in the S&P 500 Index.

You can download a spreadsheet of the 100 low volatility stocks (along with other important financial metrics like price-to-earnings ratios and dividend yields) by clicking on the link below:

This article will discuss standard deviation more thoroughly, and provide a discussion of the 5 lowest-volatility dividend stocks in the Sure Analysis Research Database.

The table of contents below allows for easy navigation.

Table of Contents

Standard Deviation Overview

Standard deviation is a calculation that involves a number of inputs, such as a security’s closing share prices over a given period of time, the mean value over that time, and the number of data points in the data set.

Why this matters is because investors can utilize standard deviation to get a better understanding of a security’s volatility, and therefore its risk.

Importantly, low or high standard deviation measures the size of the movements a security could make from its average performance.

In a normal distribution, a stock’s price action should fall within one standard distribution of its mean price, approximately 68% of the time.

Furthermore, the share price of the security in question, should be within two standard deviations of the mean, approximately 95% of the time.

To put this into perspective, assume a stock has a mean price of $100, and a standard deviation of $10. In a normal distribution, the stock in question should close between $80-$120 per share, approximately 95% of the time.

Of course, this still leaves a 5% chance that the stock will close outside the range of $80-$120. In this way, investors often use standard deviation as a proxy for risk.

The conventional wisdom would suggest that low volatility stocks should under-perform during market uptrends and outperform during downturns.

The following section discusses the 5 dividend-paying stocks in the S&P 500 with the lowest standard deviation of daily returns over the past five years.

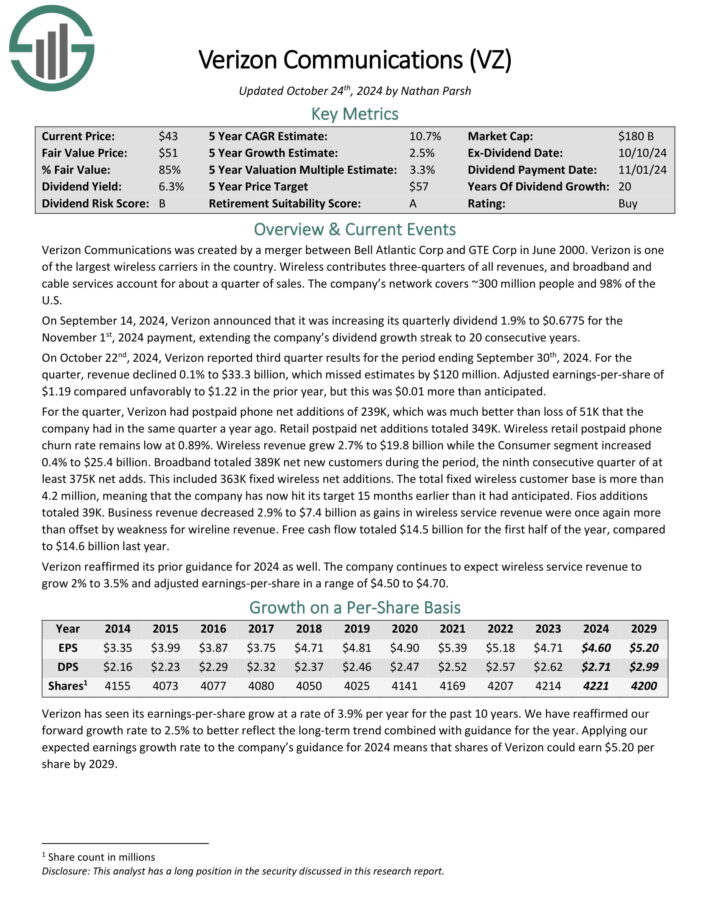

Low Volatility Stock #5: Verizon Communications (VZ)

Verizon Communications was created by a merger between Bell Atlantic Corp and GTE Corp in June 2000. Verizon is one of the largest wireless carriers in the country.

Wireless contributes three-quarters of all revenues, and broadband and cable services account for about a quarter of sales. The company’s network covers ~300 million people and 98% of the U.S.

On October 22nd, 2024, Verizon reported third quarter results for the period ending September 30th, 2024. For the quarter, revenue declined 0.1% to $33.3 billion, which missed estimates by $120 million.

Source: Investor Presentation

Adjusted earnings-per-share of $1.19 compared unfavorably to $1.22 in the prior year, but this was $0.01 more than anticipated.

For the quarter, Verizon had postpaid phone net additions of 239K, which was much better than loss of 51K that the company had in the same quarter a year ago. Retail postpaid net additions totaled 349K.

Wireless retail postpaid phone churn rate remains low at 0.89%. Wireless revenue grew 2.7% to $19.8 billion while the Consumer segment increased 0.4% to $25.4 billion.

Click here to download our most recent Sure Analysis report on VZ (preview of page 1 of 3 shown below):

Low Volatility Stock #4: Procter & Gamble (PG)

Procter & Gamble is a consumer products giant that sells its products in more than 180 countries and generates roughly $82 billion in annual sales.

Its core brands include Gillette, Tide, Charmin, Crest, Pampers, Febreze, Head & Shoulders, Bounty, Oral-B, and many more.

P&G has slimmed down to just 65 brands, from 170 previously. And these brands have been gaining global market share at a healthy rate over the past few years.

Source: Investor Presentation

In mid-October, Procter & Gamble reported (10/18/24) financial results for the first quarter of fiscal 2025. Its sales dipped -1% while its organic sales grew 2% over last year’s quarter thanks to 1% price hikes and 1% volume growth. Core earnings-per-share grew 5%, from $1.83 to $1.93, beating the analysts’ consensus by $0.03.

Management reaffirmed its guidance for 3%-5% growth of organic sales and 5%-7% growth of earnings-per-share in fiscal 2025.

Click here to download our most recent Sure Analysis report on PG (preview of page 1 of 3 shown below):

Low Volatility Stock #3: The Coca-Cola Company (KO)

Coca-Cola was founded in 1892. Today, it is the world’s largest non-alcoholic beverage company. It owns or licenses more than 500 non-alcoholic beverages, including both sparkling and still beverages.

Its brands account for about 2 billion servings of beverages worldwide every day, producing more than $45 billion in annual revenue.

The sparkling beverage portfolio includes the flagship Coca-Cola brand, as well as other soda brands like Diet Coke, Sprite, Fanta, and more.

The still beverage portfolio includes water, juices, and ready-to-drink teas, such as Dasani, Minute Maid, Vitamin Water, and Honest Tea.

Source: Investor Presentation

Coca-Cola dominates sparkling soft drinks, but the company is attempting to maintain and even improve this dominant position with product extensions of existing popular brands, including reduced and zero-sugar versions of brands like Sprite and Fanta.

Coca-Cola posted third quarter earnings on October 23rd, 2024, and results were better than expected on both revenue and profits. The company saw adjusted earnings-per-share of 77 cents, which was two cents better than estimates.

Revenue was off fractionally year-over-year to $11.9 billion, but did beat estimates by $290 million. Organic revenues were up by 9%. That included 10% growth in price and mix, a 2% decline in concentrate sales, and a 1% gain in case volumes.

Click here to download our most recent Sure Analysis report on KO (preview of page 1 of 3 shown below):

Low Volatility Stock #2: Colgate-Palmolive (CL)

Colgate-Palmolive was founded in 1806 and has built an impressive and extensive portfolio of consumer brands. It operates globally, selling in most countries around the world.

About one-sixth of its revenue comes from Hill’s pet food division, which has shown very strong growth in recent years.

The other five-sixths of revenue comes from a mix of cleaning and personal care products, with the company’s most recognizable brands being Colgate (tooth care) and Palmolive (soap).

The company has structured itself into four units: Oral Care, Personal Care, Home Care, and Pet Nutrition.

Source: Investor presentation

Colgate-Palmolive posted third quarter earnings on October 25th, 2024, and results were better than expected on both the top and bottom lines. Adjusted earnings-per-share came to 91 cents, which was three cents ahead of estimates.

Revenue was up 2.2% year-over-year to $5.03 billion, which was also $20 million ahead of expectations. North American organic sales, which are about 20% of revenue, fell 1.9% year-over-year. Latin American organic sales were up 14.2%, and up 10.8% in Africa/Eurasia.

Click here to download our most recent Sure Analysis report on CL (preview of page 1 of 3 shown below):

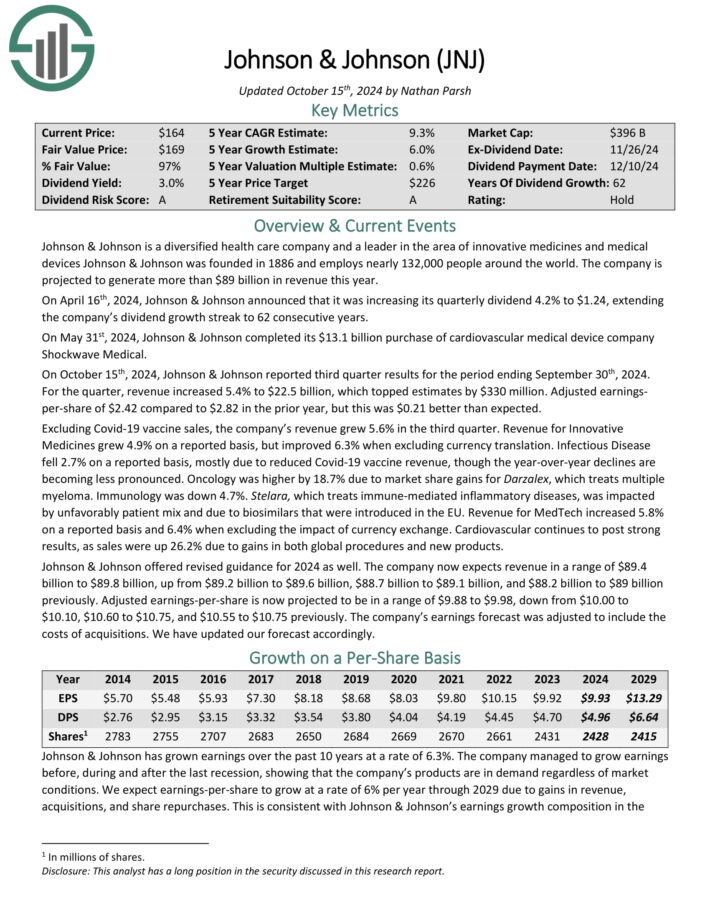

Low Volatility Stock #1: Johnson & Johnson (JNJ)

Johnson & Johnson was founded in 1886 and has transformed into one of the largest companies in the world. Johnson & Johnson is a mega-cap stock. The company generates annual sales above $99 billion.

Johnson & Johnson operates a diversified business model, allowing it to appeal to a wide variety of customers within the healthcare sector. J&J now operates two segments, pharmaceuticals and medical devices, after spinning off its consumer health franchises.

Johnson & Johnson reported third-quarter 2024 sales growth of 5.2%, reaching $22.5 billion, with operational growth of 6.3%.

Source: Investor Presentation

However, earnings per share (EPS) decreased by 34.3%, largely due to a one-time special charge and acquired in-process research and development (IPR&D).

Adjusted EPS fell 9.0% to $2.42, driven by the same IPR&D impact. The company made significant advancements, including approvals for treatments like TREMFYA and RYBREVANT, and the submission of a new general surgery robotic system, OTTAVA.

Click here to download our most recent Sure Analysis report on JNJ (preview of page 1 of 3 shown below):

Final Thoughts

Investors should take risk into account when purchasing individual stocks. After all, if two securities are otherwise similar in terms of expected returns but one offers a lower standard deviation, the investor would likely see stronger returns from the low volatility stock.

Standard deviation can help investors determine which securities will produce greater deviation from the market average.

The five stocks in the article not only have low standard deviation, but they also offer attractive dividend yields and total expected returns.

The following databases of dividend growth stocks may also be useful for income investors:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].