The S&P 500 (SPX) index is going gangbusters on Friday after the release of the November Personal Consumption Expenditures (PCE) report. That report included inflation increasing 2.3% year-over-year. While that sounds bad, investors are celebrating it coming in below economists’ estimate of 2.4%.

Pick the best stocks and maximize your portfolio:

This positive inflation news is lifting the S&P 500 higher today, sending the index up 1.81% as of this writing. That’s great news as it revitalizes hope that the Federal Reserve will consider further interest rate cuts next year.

The central bank just weighed in on interest rates earlier this week. While it cut them by 25 basis points, it also warned that rate cuts could slow next year. Investors are hopeful this latest PCE report may change the Fed’s mind, as this is the main factor behind its economic decisions.

Stocks Lifting the S&P 500 Index Higher Today

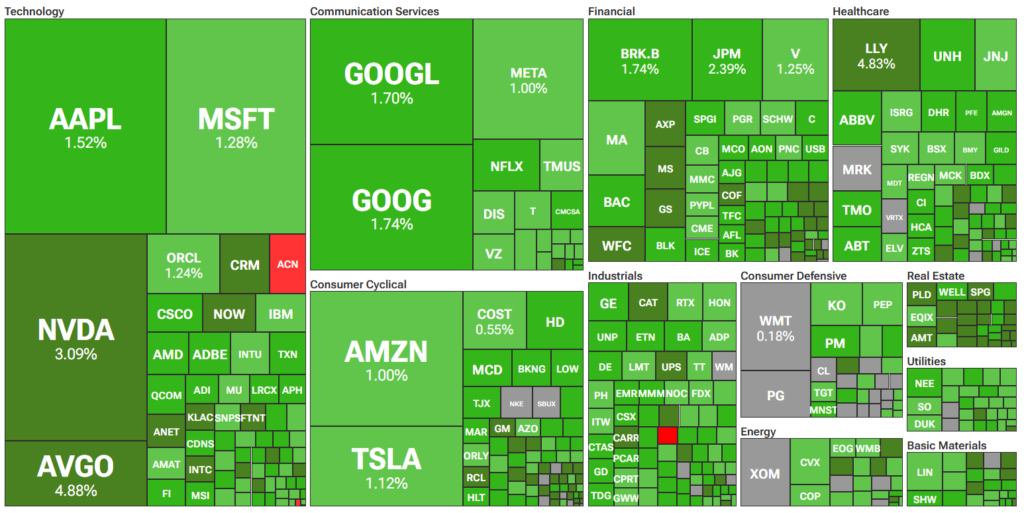

Checking out the TipRanks S&P 500 heatmap, the index is rocketing higher today, being almost completely green. Only a couple of red spots remain on the map, showing a vast majority of companies are behind the index’s monumental movement on Friday.

How to Invest in the S&P 500

Traders can’t take a direct stake in the S&P 500 due to it being an index. However, one option they might consider is buying a stock included in the index. Tech stocks have been hot lately with the recent artificial intelligence (AI) boom, making them a strong contender for investors’ funds. Nvidia (NVDA) and Broadcom (AVGO) are among those traders may contemplate taking a stake in.

Another option is buying shares of an exchange-traded fund (ETF) that tracks the S&P 500, such as the SPDR S&P 500 ETF Trust (SPY). The TipRanks comparison tool below can help investors determine which ETF they might want to invest in.

See more S&P 500 ETFs

Disclaimer