The S&P 500 (SPX) index is spiraling on Wednesday alongside results from the Federal Reserve’s Federal Open Market Committee (FOMC) meeting. That meeting saw the central bank announce a 25 basis points cut to interest rates, dropping them to between 4.25% and 4.5%. With this news comes a 0.58% drop in the SPX.

Pick the best stocks and maximize your portfolio:

Leading this fall is tech stocks, which aren’t reacting well despite the interest rate cuts. That’s thanks to them being in the growth stock category. Growth stocks are often strongly affected by interest rates, with higher ones weighing them down. While today’s cut was expected to be a positive catalyst, future concerns are weighing on these shares.

What’s Next for the S&P 500?

That depends on what the Federal Reserve does in 2025. The central bank has been considering more interest rate cuts next year. However, increasing inflation and a strengthening workforce may alter the Fed’s plans. This appears to be the case with warnings it could be some time before the next interest rate cut and some members arguing against the current one.

Another factor that could affect the Fed’s interest rate plans next year is President-elect Donald Trump taking office. Trump has already announced plans to introduce heavy tariffs on foreign goods during his presidency. Depending on how this affects the U.S. economy, it could change the central bank’s plans.

How to Invest in the S&P 500

The S&P 500 is an index, meaning traders can’t invest in it directly. Even so, there are a couple of options for those wanting exposure to it. That includes buying stocks of companies listed on the index. A few notable ones include Apple (AAPL), Microsoft (MSFT), Nvidia (NVDA), Alphabet (GOOGL), and Meta Platforms (META).

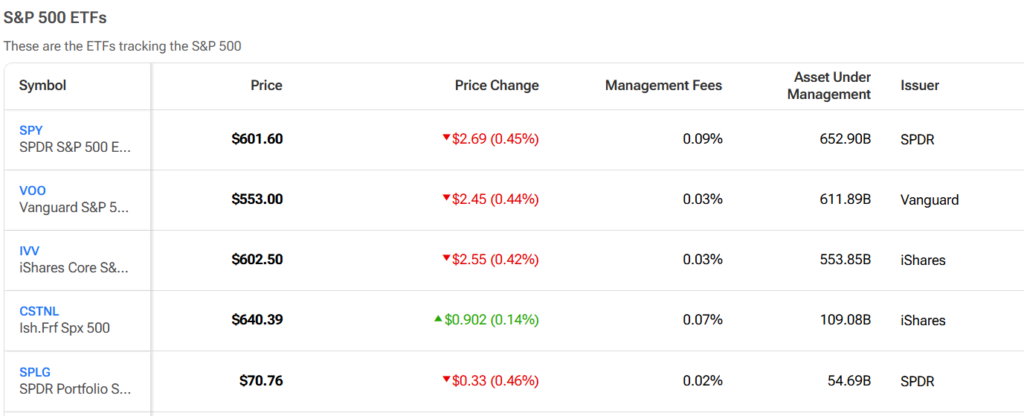

Another option is buying exchange-traded funds (ETFs) that track the S&P 500 index. Investors can weigh their options with the TipRanks ETF comparison tool below.

See more S&P 500 ETF data

Disclaimer