It was another weak day for the markets. The closed lower by 39 basis points, but the weakness was more pronounced in the , down 80 basis points. The dropped for the ninth consecutive day, losing 66 basis points.

Breadth continues to deteriorate across the marketplace. In the S&P, 378 stocks were down, while only 120 were up. Looking at the Bloomberg 500 proxy for the S&P, the decline would have been worse had Tesla (NASDAQ:) not gained 3.5%, which contributed approximately 2 points to the index, even as it finished 9 points lower. Broadcom (NASDAQ:) notably unwound, falling 4%, while Nvidia (NASDAQ:) dropped about 1%. Signs of deterioration are increasingly apparent.

(BLOOMBERG)

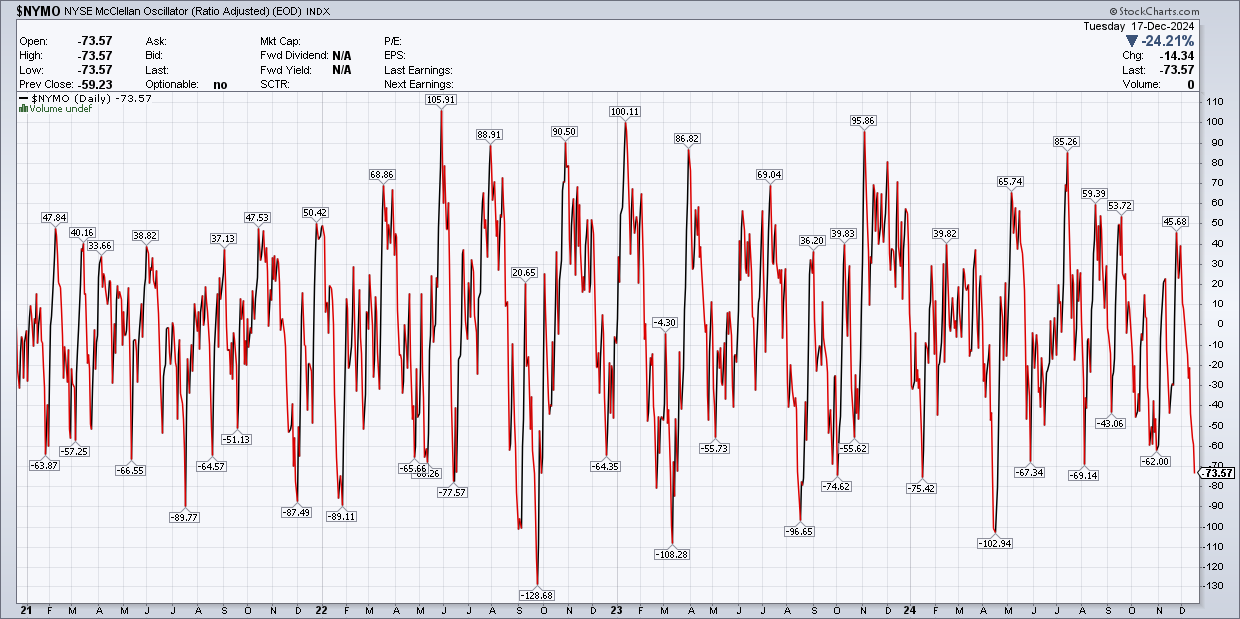

The NYSE McClellan Oscillator ratio-adjusted finished yesterday at -73.5, which is not an extremely oversold condition. For context, it hit -100 in April, so there is still room for further decline, but a reasonably low level.

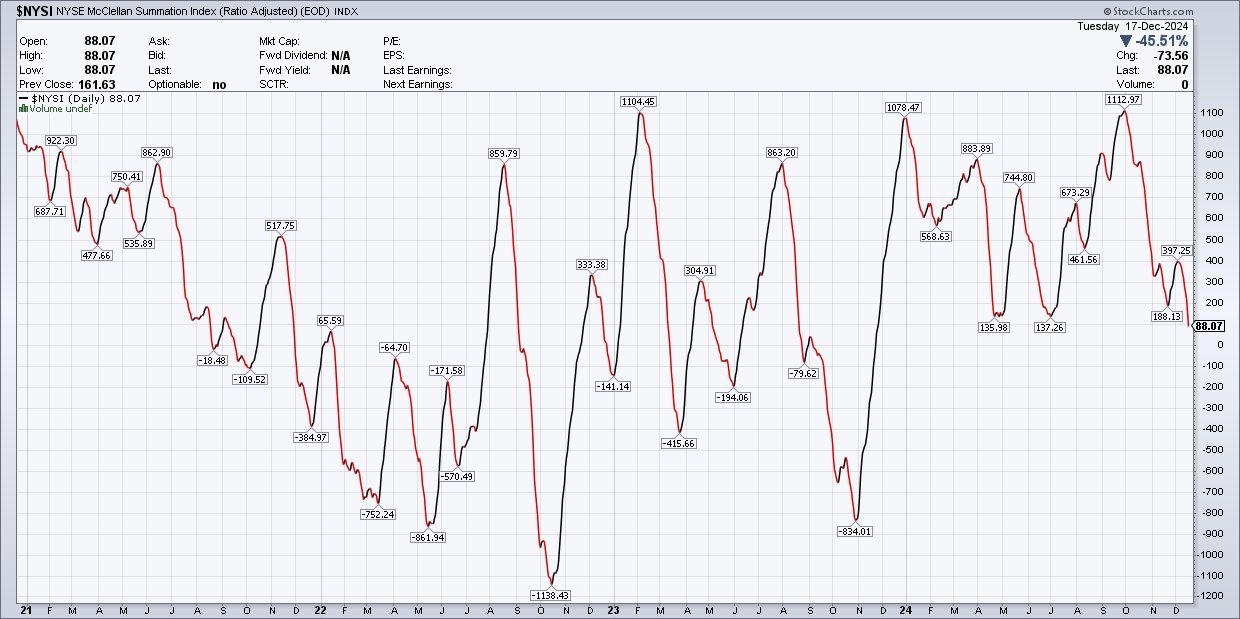

More importantly, the NYSE Summation Index—essentially a cumulative measure of the McClellan Oscillator—closed at 88.

This index becomes particularly significant if it drops below zero, which could signal broader market changes. We will need to monitor this closely.

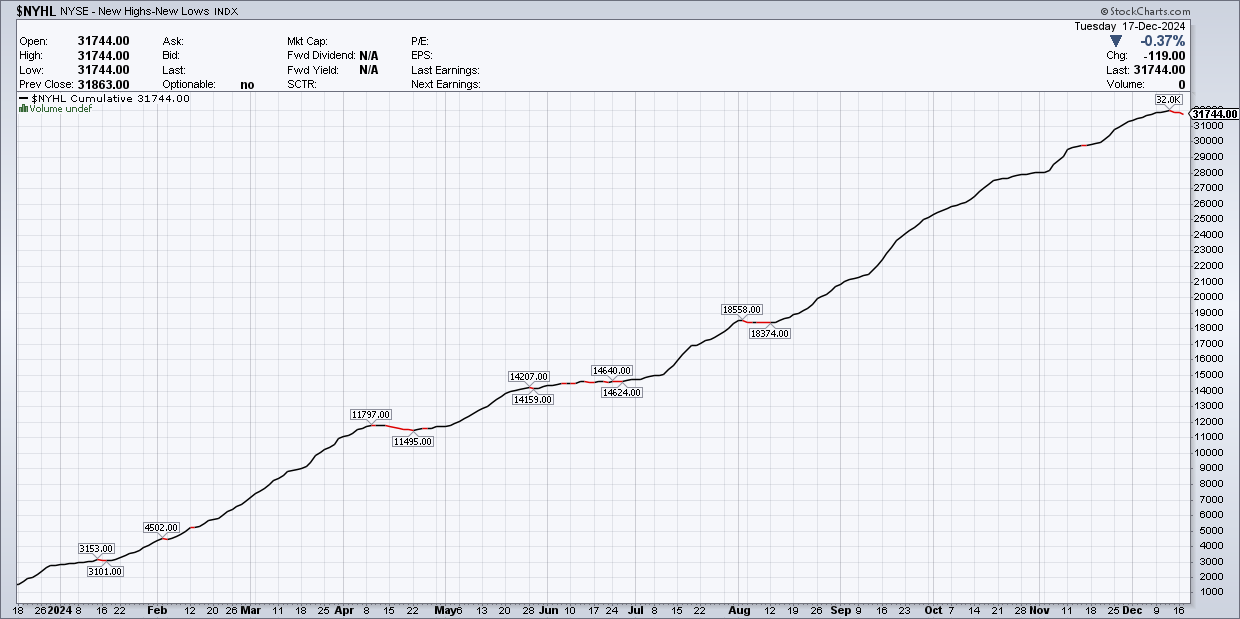

Another key indicator yesterday was NYSE new highs minus new lows, which showed 119 more new lows. On a cumulative basis, this metric appears to be rolling over, although it’s still early, and such patterns have reversed in the past.

The index continues to hold together in the S&P and broader cash markets by finding support where it can. Currently, key support lies around 6,030, while resistance remains near 6,100.

All Eyes on the Fed Today

Looking ahead, today brings the meeting. Implied volatility in this meeting is relatively low, with one-day IV at 13.5. This number will likely climb as we approach the meeting and fall after the press conference begins, creating that volatility crush and potential SPX spike higher.

Yesterday’s data was solid, yet the remained flat, finishing just a little lower. What’s particularly notable is the global rates setup, especially in the UK and Japan.

The United Kingdom (TADAWUL:) and yields are approaching big levels last seen during the fall of 2022 and summer of 2023. We are now back to the highs reached during the September 2022 “mini-budget” turmoil under Liz Truss and Kwasi Kwarteng.

Similarly, JGBs are near their highs and appear poised to break out. This suggests the bond market is pricing in a potential rate hike from the BOJ on Thursday—something that would defy expectations of inaction.

If global rates continue rising, particularly in the UK and Japan, U.S. 10-year yields could follow suit, as global markets are highly interconnected.

Lastly, financing costs for equity exposure are becoming increasingly expensive. yesterday, January contracts for the BTIC S&P 500 Total (EPA:) Return Futures settled at 227 basis points above Fed funds rates, while March contracts closed 180 basis points above.

December contracts, meanwhile, sit at 121.5 basis points. The January contracts are now trading 105 points above December, and March contracts are trading 47.5 points below January. These levels suggest some of the highest financing costs for equity exposure since 2008. I hope to share more visualized data on this today.

Have a great night, and I’ll see you soon!