How New S&P 500 Companies Performed in 2024

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

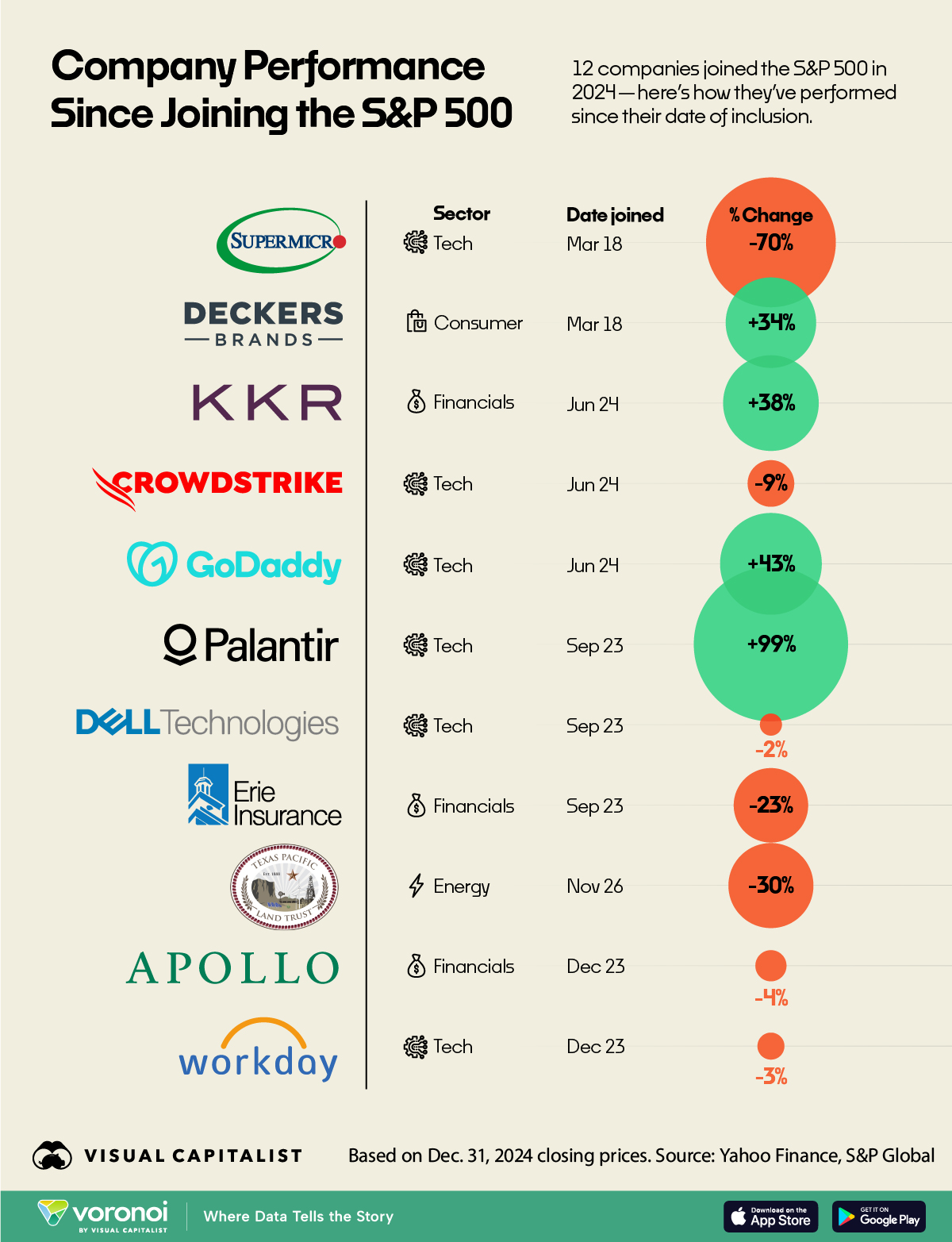

This graphic shows how the new S&P 500 companies added in 2024 have performed since their start date, as of year-end (Dec. 31, 2024).

Note that Amentum Holdings, the 12th addition of 2024, is not included in this graphic because it was also removed during the same year on Dec. 23.

Data and Key Takeaways

The data we used to create this graphic is listed in the table below. Price changes are as of Dec. 31, 2024.

| Company | Sector | Date Joined | Price Change (%) |

|---|---|---|---|

| Super Micro | 🤖 Tech | March 18, 2024 | -70% |

| Deckers | 🛍️ Consumer | March 18, 2024 | 34% |

| KKR | 🏦 Financials | June 24, 2024 | 38% |

| Crowdstrike | 🤖 Tech | June 24, 2024 | -9% |

| GoDaddy | 🤖 Tech | June 24, 2024 | 43% |

| Palantir | 🤖 Tech | Sept. 23, 2024 | 99% |

| Dell | 🤖 Tech | Sept. 23, 2024 | -2% |

| Erie Insurance | 🏦 Financials | Sept. 23, 2024 | -23% |

| Texas Pacific Land | 🛢️ Energy | Nov. 26, 2024 | -30% |

| Apollo Global Management |

🏦 Financials | Dec. 23, 2024 | -4% |

| Workday | 🤖 Tech | Dec. 23, 2024 | -3% |

The best-performing new S&P 500 company of 2024 is Palantir Technologies, a growing AI and data analytics company.

Palantir shares climbed 340% overall in 2024 as demand for its software grew significantly. One of its largest clients is the U.S. military, which recently awarded the company a $400 million four-year contract.

Meanwhile, the worst-performing S&P 500 entrant is Super Micro Computer, which started 2024 with a massive rally but then ran into regulatory troubles. Many are speculating that Super Micro could soon be delisted from the S&P 500.

The Benefits of S&P 500 Inclusion

The S&P 500 is one of the most widely followed indices in the world, and being added to it can provide companies with powerful advantages.

One advantage is increased visibility and investor recognition, which could help a company raise capital more easily in the future.

Another advantage is greater demand for shares. When a company is added to the S&P 500, mutual funds and ETFs that track the index must buy shares to stay in compliance with their mandate.

According to VettaFi, the world’s three largest S&P 500 ETFs have a combined assets under management (AUM) of nearly $1.8 trillion.

Learn More on the Voronoi App

If you enjoyed this post, check out S&P 500 Returns by Sector in 2024 on Voronoi, the new app from Visual Capitalist.