The S&P 500 (SPX) is soaring on Monday as the stock market waits in anticipation of the outcome of the approaching Federal Reserve meeting. This meeting will have the Fed decide if an interest rate drop will go into effect this month. That’s a major catalyst for the stock market as increased interest rates have weighed on it over the last couple of years.

Pick the best stocks and maximize your portfolio:

Experts expect the Fed will announce a 25-basis point interest rate cut after this meeting, which is set for Dec. 17 and Dec. 18. If that happens, the S&P 500 will likely benefit from the news. The index is already performing well ahead of that meeting with a 0.49% increase as of this writing and a 26.86% gain year-to-date.

Stocks Lifting the S&P 500 Index Higher Today

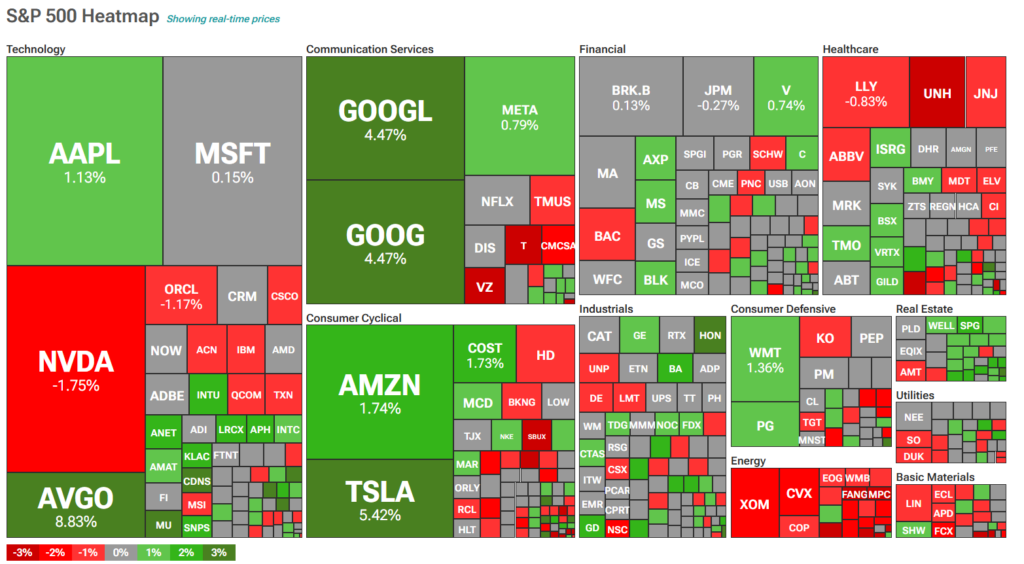

A huge portion of the S&P 500 index’s increase on Monday comes from tech stocks. Specifically, Broadcom (AVGO) is a major contributor with its 8.83% rally as of this writing. Helping it out are Alphabet (GOOGL), with both classes of its shares up more than 4%, as well as an over 5% increase for Tesla (TSLA) stock.

One notable stock that is slipping today is Nvidia (NVDA), which is down 1.75%. It’s worth mentioning that NVDA and AVGO are rivals, meaning that the stock might be down today in reaction to Broadcom’s rise.

How Do Traders Invest in the S&P 500?

Traders can’t invest in the S&P 500 directly as it’s an index. Even so, there are a couple of ways to gain exposure to it, including buying any of the shares in the heatmap above.

Another option is investing in exchange-traded funds (ETFs) that track the S&P 500. A few examples are SPDR S&P 500 ETF Trust (SPY), iShares Core S&P 500 ETF (IVV), Vanguard S&P 500 ETF (VOO), iShares Core S&P 500 UCITS ETF (CSTNL), and SPDR Portfolio S&P 500 ETF (SPLG).

See more S&P 500 ETFs

Disclosure