The Fed giveth and the Fed taketh away.

That’s the lesson for investors following the week-to-week action in the S&P 500 (SPX), which fell by over 0.6% to close out the trading week ending on Friday, 13 December 2024 at 6,051.09.

That retreat came after the preceding week’s near one-percent gain, which came as expectations there would be three rate cuts in 2025 took hold. But just one week later, the CME Group’s FedWatch Tool projects only two rate cuts in 2025, quarter-point reductions that will be announced on 19 March (2025-Q1) and 18 September (2025-Q3). A third rate cut in 2025-Q2 now seems to no longer be in the forecast.

Meanwhile, the CME Group’s is giving 96% probability the Fed reduce the Federal Funds Rate by 0.25% later this week, on Wednesday, 18 December 2024. Investors will be paying close attention to statements being made by Fed officials, particularly if they give any suggestion as to the prospects of a rate cut in 2025-Q2.

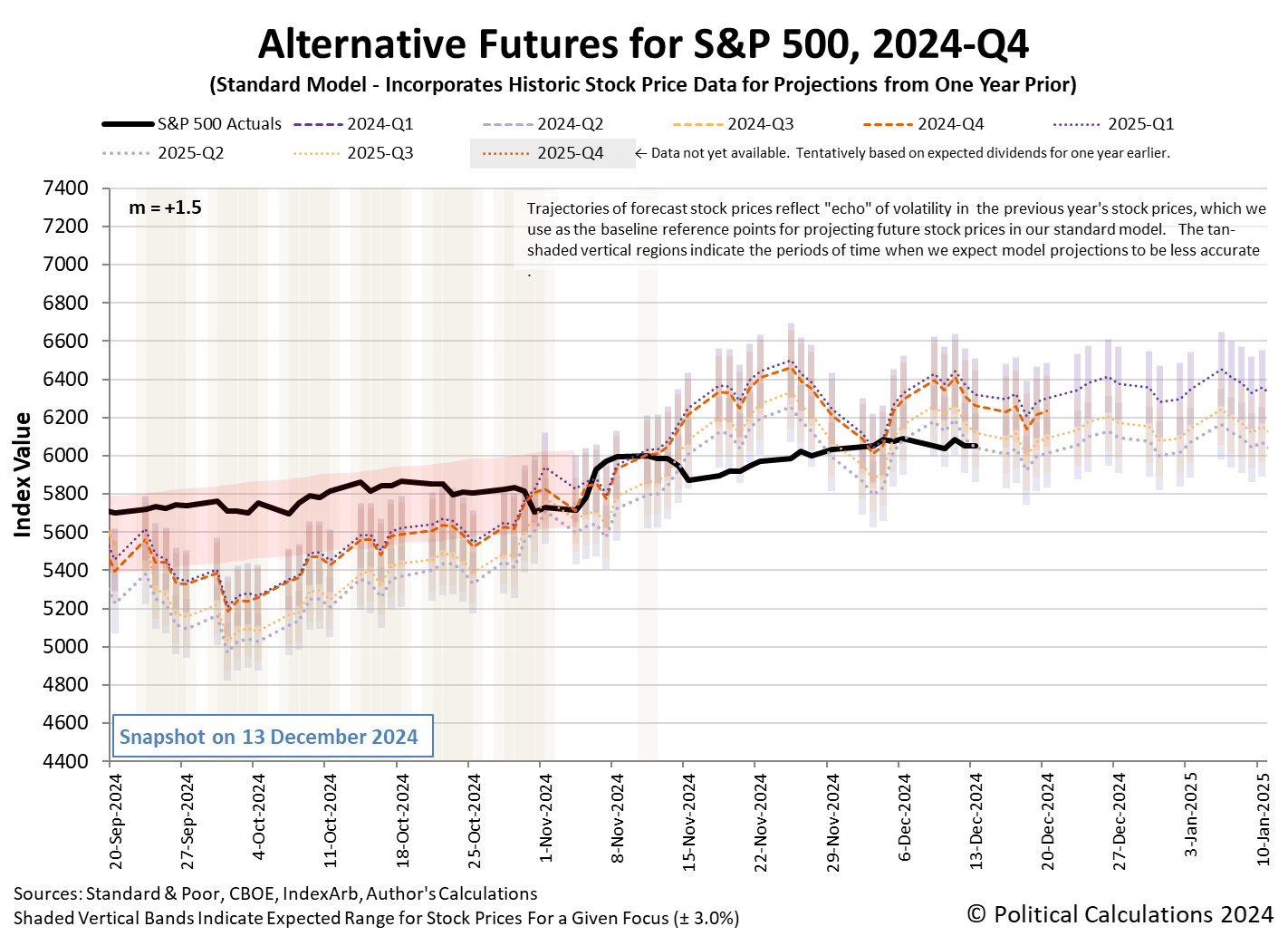

This future quarter matters because investors are closely focusing their forward-looking attention on it as they set current-day stock prices. The latest update of the alternative futures chart shows where things currently stand:

What happens next depends on the random onset of new information, although in this upcoming week, the new information with the most potential to reshape the future expectations of investors is scheduled. Until then, here are the past week’s market-moving headlines:

Monday, 9 December 2024

- Signs and portents for the U.S. economy:

- Fed officials December 2024 rate cut “baked in”:

- Bigger stimulus, trouble developing in China: