Wealthfront’s new S&P 500 Direct portfolio combines the performance of the S&P 500® with the added benefit of tax savings and is available for just 0.09% – the same price as the most popular ETF that tracks the S&P 500®

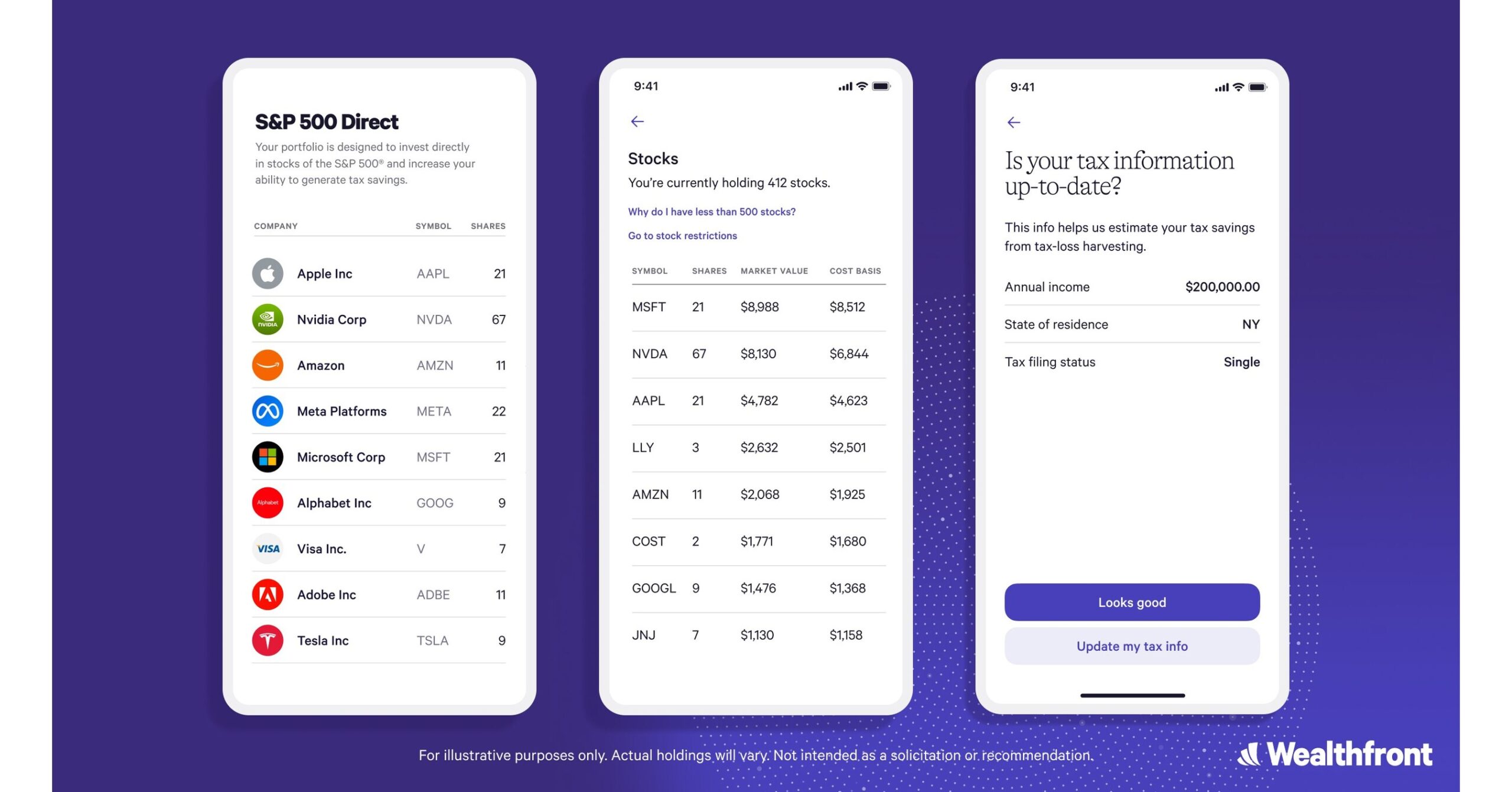

PALO ALTO, Calif., Dec. 17, 2024 /PRNewswire/ — Wealthfront, a tech-driven financial platform for young professionals, today announced a new product that combines the performance of the S&P 500® with the added tax benefits of automated tax-loss harvesting for the same price as the most popular ETF that tracks the S&P 500®. Wealthfront’s new S&P 500 Direct portfolio is available for a low 0.09% fee – the same expense ratio as the leading SPDR® S&P 500® ETF Trust – and investors can get started with $20,000.

“Wealthfront has long been a leader in tax optimization, with services like our automated Tax-Loss Harvesting that has captured over $3.4 billion in harvested losses since its launch, which could be worth an estimated $1.19 billion in tax savings for our clients,” said Dave Myszewski, Vice President of Product at Wealthfront. “Today’s launch combines our powerful Tax-Loss Harvesting expertise with the performance of the S&P 500® index, and is another example of how we use software to lower costs and deliver more value to the next generation of investors.”

Wealthfront’s S&P 500 Direct portfolio offers more tax benefits than investing in a single ETF that tracks the performance of the S&P 500® because it allows clients to directly hold shares of companies in the index, and uses automated Tax-Loss Harvesting to capture losses from daily price movements in those stocks even when the index is up overall. This new portfolio is ideal for investors who want exposure to the S&P 500® and have gains from stock compensation because it is designed to generate enhanced tax savings. Harvested losses can be used to offset capital gains, and any remaining losses can offset up to $3,000 in ordinary income. Any unused losses carry over indefinitely to future years.

Wealthfront’s S&P 500 Direct product is based on the S&P 500® Index, which is licensed by S&P Dow Jones Indices (S&P DJI). “As an independent index provider with more than a century of experience in creating iconic and trusted market benchmarks, S&P DJI is excited to provide its market-leading index and related data to Wealthfront for the first time,” said Brandon Hass, Head of Direct Indexing and Model Portfolios at S&P DJI. “Through this licensing arrangement, S&P DJI will be able to deliver the S&P 500® index, widely known as the best single gauge of the U.S. equity market, on the Wealthfront platform to market participants interested in tax-loss harvesting solutions, which continue to become increasingly popular in the digital wealth solutions space due to their enhanced tax benefits and highly customizable nature.”

Wealthfront’s product-led growth strategy continues to pay off and the company currently oversees nearly $80 billion for over 1 million clients. Today’s launch caps off a year of multiple product expansions, including a first-of-its-kind Automated Bond Ladder that makes it easy to invest in a ladder of US Treasuries and lock in a competitive yield with zero state taxes. The company also recently made available free, instant withdrawals and removed wire fees for its award-winning Cash Account offering 4.25% APY and up to $8M FDIC insurance, on deposits through partner banks. For more information on Wealthfront’s S&P 500 Direct portfolio visit www.wealthfront.com/sp500-direct.

About Wealthfront

Wealthfront is a tech-driven financial platform built to help young professionals turn their savings into long-term wealth. Through software, the company delivers cash management, diversified ETF and bond investing, zero-commission stock investing, and low-cost loans to help sophisticated and new investors learn, lower costs, and grow wealth. Wealthfront is one of the highest-rated financial apps in the Apple App Store and has been named Best Automated Investment App, Best Overall Robo-Advisor, and Best Robo-Advisor in the Portfolio Construction, Portfolio Management, and Goal Planning categories by Investopedia (2024), Best Cash Management Account and Best Investing App by Bankrate (2024), and Best Robo-Advisor for Portfolio Options by NerdWallet (2024). The company currently oversees nearly $80 billion for over 1 million clients in the US. To learn more please visit www.wealthfront.com or download the app on the App Store or Google Play.

Disclosures

The S&P 500® (the “Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates (“S&P DJI”) and/or their third-party licensors and has been licensed for use by Wealthfront. S&P®, S&P 500®, SPDR®, US 500™, The 500™, are trademarks of S&P Global, Inc. or its affiliates (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”); third party licensor trademarks in the Index, if any, are trademarks of the respective third party licensors. The S&P 500 Index and S&P 500® have been licensed for use by S&P DJI and sublicensed for certain purposes by Wealthfront. Wealthfront’s statements are not endorsed by and Wealthfront’s products are not sponsored, endorsed, sold or promoted by S&P DJI, Dow Jones, S&P, their respective affiliates, or their third-party licensors and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of the Index.

The reference to SPDR® as the most popular ETF that tracks the S&P 500® comes from VettaFi: https://etfdb.com/compare/market-cap/

The effectiveness of the tax-loss harvesting strategy to reduce the tax liability of the client will depend on the client’s entire tax and investment profile, including purchases and dispositions in a client’s (or client’s spouse’s) accounts outside of Wealthfront Advisers and type of investments (e.g., taxable or nontaxable) or holding period (e.g., short-term or long-term).

Tax-loss harvesting involves certain risks, including, among others, the risk that the new investment could have higher costs than the original investment and the strategy could introduce portfolio tracking error into your account. Tracking error is a measure of financial performance that determines the difference between the return fluctuations of an investment portfolio and the return fluctuations of a chosen benchmark. There may also be unintended tax implications. In addition, tax loss harvesting strategies may produce losses, which may not be offset by sufficient gains in the account and may be limited to a $3,000 deduction against income.

Wealthfront Advisers and its affiliates do not provide legal or tax advice and do not assume any liability for the tax consequences of any client transaction. Clients should consult with their personal tax advisors regarding the tax consequences of investing with Wealthfront Advisers and engaging in these tax strategies, based on their particular circumstances.

Wealthfront Advisers is compensated for its advisory services by charging an annual account fee of 0.09% on the net market value of a Client’s account.

Indices are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management of an actual portfolio.

The Cash Account is offered by Wealthfront Brokerage LLC, Member of FINRA/SIPC. Wealthfront Brokerage is not a bank. We convey funds to partner banks who accept and maintain deposits, provide the interest rate, and provide FDIC insurance. The APY rate is as of December 4, 2024 and is subject to change. Investment management and advisory services–which are not FDIC insured–are provided by Wealthfront Advisers LLC (“Wealthfront Advisers”), an SEC-registered investment adviser.

The information contained in this communication is provided for general informational purposes only, and should not be construed as tax advice, a solicitation or offer, or recommendation, to buy or sell any security. All investing involves risk, including the possible loss of money you invest, and past performance does not guarantee future performance.

Investopedia receives cash compensation for referring potential clients to Wealthfront Advisers, LLC (“Wealthfront Advisers”) via advertisements placed on their website which could create an incentive creating a material conflict of interest. While they receive compensation for referring potential clients, the statements and rankings provided above represent independent endorsements by Investopedia, which are not directly tied to such compensation. Investopedia and Wealthfront Advisers are not associated with one another and have no formal relationship outside of this arrangement. Investopedia’s opinions are their own. Their ratings are determined by their editorial team. Investopedia is not a client of Wealthfront Advisers. Investopedia designed a system that rates robo-advisors based on nine key categories and 59 variables. Each category covers critical elements users need to thoroughly evaluate a robo-advisor. The ratings reflect data and evaluations for the 12-month period ending in February 2024. Learn more about their methodology and review process. Investopedia ranking as of March 2024.

Bankrate receives cash compensation for referring potential clients to Wealthfront Advisers, LLC (“Wealthfront Advisers”) and Wealthfront Brokerage, LLC (“Wealthfront Brokerage”) via advertisements placed on their website which could create an incentive creating a material conflict of interest. While they receive compensation for referring potential clients, the statements and rankings provided above represent independent endorsements by Bankrate, which are not directly tied to such compensation. Bankrate and Wealthfront are not associated with one another and have no formal relationship outside of this arrangement. Bankrate’s opinions are their own. Their ratings are determined by their editorial team. Bankrate is not a client of Wealthfront Advisers. Bankrate designed a methodology that evaluates app-based financial services—including robo-advisors, brokerages, and mobile-only platforms, assessing overall experience, features offered and total value proposition to the investor. Best Investing App 2023 was awarded on January 10, 2023 based on data and evaluations over the 12-month period ending in December 2022. Bankrate also designed a methodology that evaluates non-bank cash accounts, evaluating APYs, checking features, service fees, minimum deposit and balance requirements and other factors. Best Cash Management Account 2024 was awarded on December 12, 2023 covering the 2023 calendar year. Wealthfront pays an annual license fee to use Bankrate’s awards in marketing materials. Learn more about their methodology and review process.

Nerdwallet receives cash compensation for referring potential clients to Wealthfront Advisers, LLC (“Wealthfront Advisers”) via advertisements placed on their website. Nerdwallet and Wealthfront Advisers are not associated with one another and have no formal relationship outside of this arrangement. Nerdwallet’s opinions are their own. Their ratings are determined by their editorial team. The scoring formula for online brokers and robo-advisors takes into account over 15 factors, including account fees and minimums, investment choices, customer support and mobile app capabilities. Nerdwallet ranking as of June 2024.

Investment management and advisory services are provided by Wealthfront Advisers LLC (“Wealthfront Advisers”), an SEC-registered investment adviser, and brokerage related products, including the Cash Account, are provided by Wealthfront Brokerage LLC, a Member of FINRA/SIPC.

Wealthfront, Wealthfront Advisers and Wealthfront Brokerage are wholly owned subsidiaries of Wealthfront Corporation.

The figures referenced in Dave Myszewski’s quote were from our blog posts published on 4/14/23 and 4/11/24. Regarding the $3.4 billion in harvested losses over the last decade, $256 million was harvested in 2023, and $2.7 billion harvested over the last 5 years. Assuming a combined 37.5% marginal tax rate, the losses harvested over the last decade could be worth an estimated $1.19 billion in tax savings to clients. For more information on tax-loss harvesting, read our whitepaper.

Media contact:

Elly Stolnitz

[email protected]

603-660-8762

SOURCE Wealthfront